- 24th September 2019, Radisson Mumbai Andheri MIDC

- 10th October 2019, JW Mariott Aerocity Delhi

- 8th November 2019, Sheraton Grand Pune Bund Garden Hotel

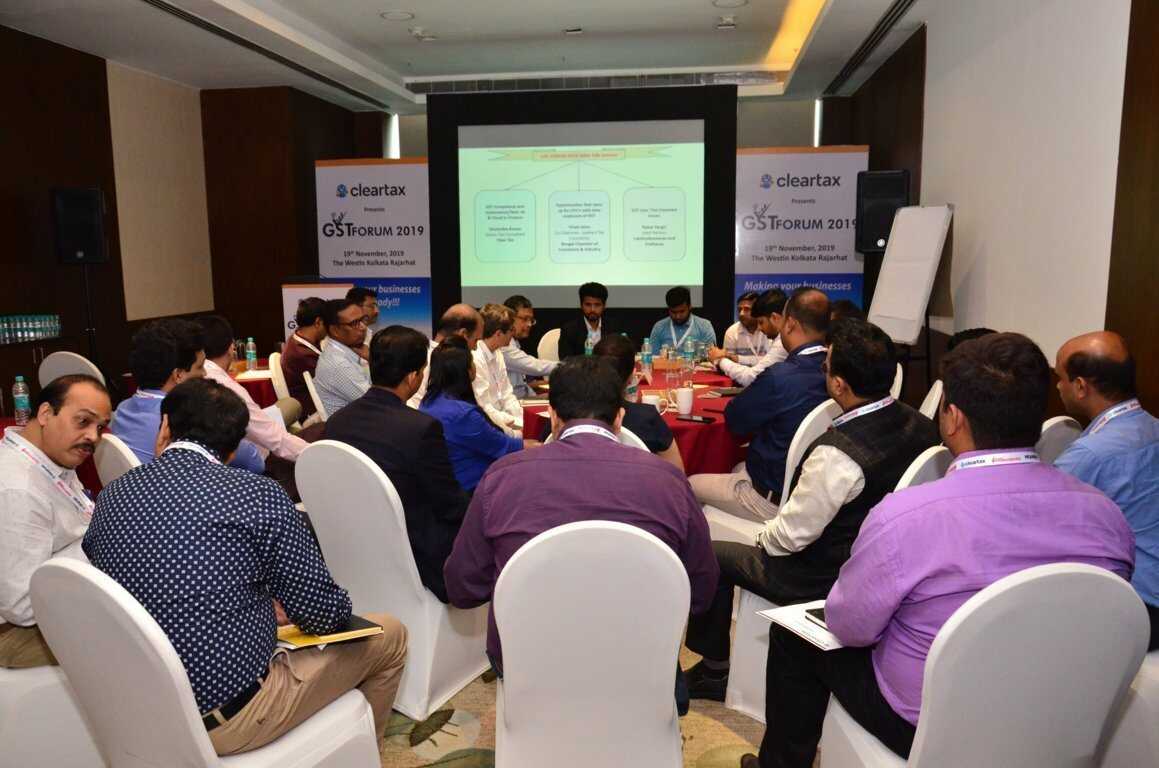

- 19th November 2019, The Westin Kolkata Rajarhat

- 26th November 2019, Four Seasons Hotel Bengaluru at Embassy ONE

- 3rd December 2019, The Westin Chennai Velachery

- 10th December 2019, Renaissance Ahmedabad Hotel

Making Your Businesses GST Ready

The Goods and Services Tax Law has brought new opportunities for all accountants and tax practitioners to grow their tax practice. The government has unveiled a transition plan for taxpayers under the goods and services tax to switch to new simpler return forms & ease the transition process across industries for both Chartered Accountants and Businesses.

The GST Forum 2019 will Equip and upgrade you on the latest advancements in GST. Making your businesses GST Ready!!!

Learning outcomes:

- Understanding the Differences between Current Vs New GST Return Systems

- Transition plan to the New GST Return System

- Evaluating the Offline Demo Tool Prototype

- Updates on the Important Changes introduced in the New GST Return System

- Upload of Invoices under the New GST Return System

- Input Tax Credit (ITC) under the New GST Return System

- Amendment Returns under the New GST Return System

Who attended:

- CXO’S, Vice presidents & Directors and Head of Indirect Tax

- Chief Financial Officers

- CROs

- GST Professionals